Social Sciences and Humanities Research Council of Canada

Quarterly Financial Report for the Quarter Ended June 30, 2021

Statement outlining results, risks and significant changes in operations, personnel and programs

Table of Contents

1. Introduction

This Quarterly Financial Report (QFR) has been prepared by management as required by section 65.1 of the Financial Administration Act (FAA), and in the form and manner prescribed by the Treasury Board. It should be read in conjunction with the 2021-22 Main Estimates. This report has not been subject to an external audit or review.

1.1 Authority, mandate and programs

The Social Sciences and Humanities Research Council of Canada (SSHRC) was established in 1977 by the Social Sciences and Humanities Research Council Act, and is a departmental corporation named in Schedule II of the FAA. SSHRC is a funding agency that promotes and supports postsecondary research and training in the social sciences and humanities to enhance the economic, social and cultural development of Canada, its communities and regions. Social sciences and humanities research builds knowledge about people in the past and present, with a view toward creating a better future.

Further information on the SSHRC mandate and program activities can be found in Part II of the Main Estimates.

1.2 Basis of presentation

Management prepared this quarterly report using an expenditure basis of accounting. The accompanying Statement of Authorities includes SSHRC’s spending authorities granted by Parliament and those used by the agency, consistent with the Main Estimates for fiscal 2021-22. This quarterly report has been prepared using a special-purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before the Government of Canada can spend monies. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

SSHRC uses the full accrual method of accounting to prepare and present its annual financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of fiscal year-to-date results

This section highlights the significant items that contributed to the change in resources available for the fiscal year, as well as the actual year-to-date expenditures compared with the previous fiscal year.

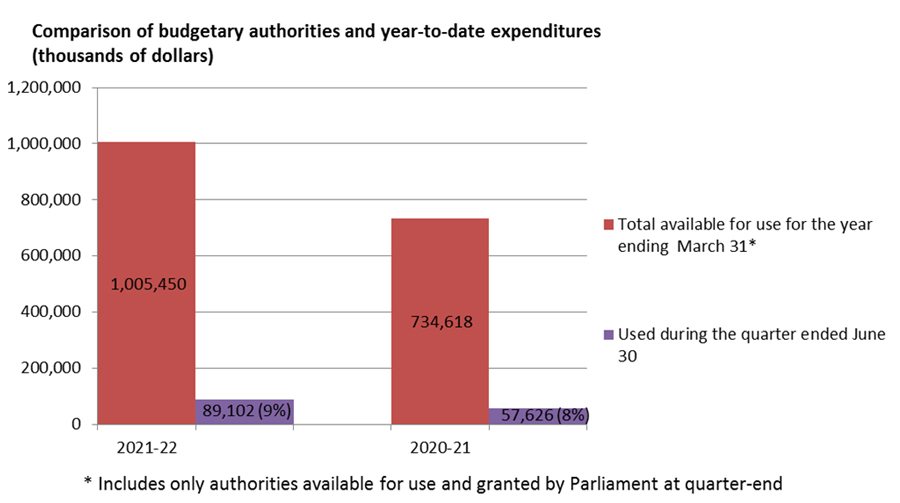

The following graph provides a comparison of budgetary authorities available for the full fiscal year and budgetary expenditures by quarter for fiscal 2021-22 and fiscal 2020-21.

Description of figure

Comparison of budgetary authorities and year-to-date expenditures (thousands of dollars)

This stacked bar graph shows SSHRC’s budgetary expenditures compared to the budgetary authorities by quarter for the current and prior fiscal year.

The x-axis shows the fiscal years in question: 2021-22 and 2020-21.

The y-axis shows the amounts in thousands of dollars from zero to $1,200,000.

SSHRC’s budgetary authorities and expenditures in fiscal year 2021-22 were as follows:

- Budgetary authorities: $1,005,450

- Authorities used during the quarter ended June 30, 2021: $89,102 (9%)

SSHRC’s budgetary authorities and expenditures in fiscal year 2020-21 were as follows:

- Budgetary authorities: $734,618

- Authorities used during the quarter ended June 30, 2020: $57,626 (8%)

2.1 Significant changes to budgetary authorities

As of June 30, 2021, SSHRC’s total available authorities for fiscal 2021-22 amounted to $1.0 billion. This represents an overall increase of $270.8 million (36.9%) from the comparative period of the previous year. The major changes in SSHRC’s budgetary authorities between the current and previous fiscal years include:

- an increase of $243.0 million due to the exceptional withholding of 3/12ths of the supply of Main Estimates in Q1 2020-21, with full supply being approved in December 2020 as a result of the implementation of COVID-19 measures. The full supply was approved during the first quarter in 2021-22;

- an increase of $12.5 million from Budget 2018 to the Research Support Fund, supporting researchers with the necessary space at postsecondary institutions to undertake research and to improve accountability and reporting for the program;

- an increase of $11.7 million from Budget 2018 supporting investigator-led discovery research in the social sciences and humanities; and

- an increase of $3.0 million from Budget 2019 to increase the number of scholarship awards through the Canada Graduate Scholarships program and expanding the paid parental leave coverage.

2.2 Significant changes to authorities used

Year-to-date spending

The following table provides a comparison of cumulative spending by vote for the current and previous fiscal years.

| Year-to-date budgetary expenditures used at quarter-end (millions of dollars) | 2021-22 | 2020-21 | Variance |

|---|---|---|---|

Vote 1—Operating expenditures |

|||

Personnel |

8.1 | 7.4 | 0.7 |

Non-personnel |

1.0 | 0.9 | 0.1 |

Vote 5—Grants and scholarships |

80.0 | 49.3 | 30.7 |

Total budgetary expenditures |

89.1 | 57.6 | 31.5 |

Total budgetary expenditures amounted to $89.1 million at the end of the first quarter of fiscal 2021-22, compared to $57.6 million reported in the same period in the previous fiscal year.

Grants and scholarships

At the end of the first quarter of fiscal 2021-22, the grant and scholarship expenses increased by $30.7 million, compared to what was reported in the same period of the previous fiscal year. The increase is mainly due to the timing of payments.

Operating expenditures

Salary expenditures have increased by $0.7 million compared to the first quarter of 2020-21, due mainly to new initiatives implemented by SSHRC in the context of equity, diversity and inclusion (EDI).

Non-salary expenditures for the first quarter of fiscal 2021-22 are in line with the same period of the previous year.

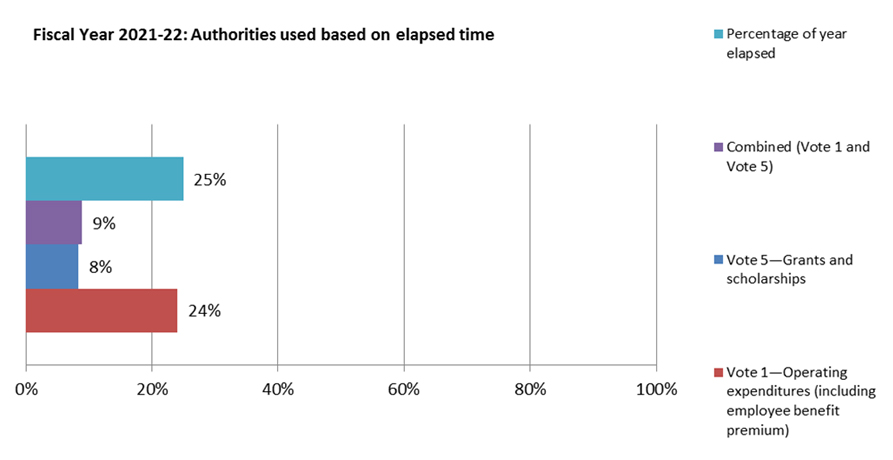

Total authorities used at the end of the first quarter of fiscal 2021-22 ($89.1 million) represent 9% of total available authorities ($1.0 billion).

Description of figure

Fiscal year 2021-22: Authorities used based on elapsed time

This bar graph shows SSHRC’s spending trend, in percentage of elapsed time, in fiscal year 2021-22.

The x-axis shows the percentages from zero to 100% in increments of 20%.

SSHRC’s authorities based on elapsed time in fiscal year 2021-22 were as follows:

- Percentage of year elapsed: 25%

- Combined authorities (Vote 1 and Vote 5): 9%

- Vote 5—Grants and scholarships: 8%

- Vote 1—Operating expenditures (including employee benefit premium): 24%

3. Risks and uncertainties

Through the corporate risk identification exercise, SSHRC annually identifies and assesses corporate-level risks and develops response measures to minimize their likelihood and/or impact. Senior management closely follows the risks below to ensure they are continuously mitigated and that the residual risk level is acceptable. This monitoring will include assessments of SSHRC’s operating environment given the ongoing impacts of the COVID-19 pandemic.

Strategic risk 1—Ability to manage resources

SSHRC’s ability to deliver results is influenced by internal and external elements and opportunities, such as the COVID-19 pandemic and the remote-first work context, and emerging government priorities and policies. To ensure strong oversight of SSHRC’s achievement of results, SSHRC relies on key planning documents, such as its strategic plan and Departmental Results Framework, and its corporate governance structure.

Strategic risk 2—Ability to manage change

Planned activities in support of SSHRC objectives are vulnerable to the management of change, including the cumulative impact of multiple changes. SSHRC has a number of key activities for fiscal 2021-22 that involve new technologies, organizational changes, new collaborations, new program directions and external factors affecting the organization. To ensure successful completion and minimize unintended impacts on other projects and on operations, SSHRC continues to implement mandatory training, the People Strategy, the Performance Management Program, the Corporate Communications strategy, which includes an employee communications plan, and other strategies to help ensure the appropriate development of employees in a changing work environment.

Strategic risk 3—Ability to manage reputation

Management of SSHRC’s reputation is a critical driver of SSHRC’s success. To ensure that challenges to SSHRC’s reputation caused by transformative changes in its operations, including implementing time-sensitive / high-profile COVID-19 emergency funding, are effectively managed, SSHRC engages frequently with stakeholders and partners. It also collaborates closely with other federal research funding agencies to establish and maintain effective relationships and enable information sharing.

Strategic risk 4—Legacy technology

SSHRC may not be able to ensure continuity of all business operations due to internal considerations, including the suite of legacy information management and information technology systems being unable to support new operations requiring new programs or substantive changes to existing programs, or due to external environmental considerations, such as the COVID-19 pandemic and the subsequent recovery period. SSHRC will ensure operational continuity and manage its engagements and reputation with stakeholders with an operational plan for legacy maintenance support, including a risk mitigation strategy that is appropriately prioritized and resourced. The agency will also introduce flexibility in program delivery, and with the ongoing monitoring and adjustments of funding application deadlines and adjudication timelines.

Read more about SSHRC’s key risks for the current fiscal year in the 2021-22 Departmental Plan.

4. Significant changes related to operations, personnel and programs

As announced as part of Budget 2021, SSHRC will administer $12 million over three years, starting in 2021-22, to support community-based research conducted through the Race, Gender and Diversity Partnership Fund. This increased funding will specifically target community-based research to improve the understanding of the causes of discrimination, the impact of oppression and identify strategies to support justice, equality and accountability. Budget 2021 also included $250 million over four years, starting in 2021-22, for the federal research granting agencies to create a new, tri-agency biomedical research fund, to be administered by SSHRC.

On June 1, 2021, SSHRC announced the appointment of a new Chief Financial Officer and Vice-President for Common Administrative Services for NSERC and SSHRC, as of July 5, 2021.

Approved by:

Original signed by

Ted Hewitt, PhD

President

Original signed by

Dominique Osterrath

Vice-President and Chief Financial Officer

Ottawa, Canada

August 27, 2021

5. Statement of authorities (unaudited)

Fiscal year 2021-22

| (in thousands of dollars) | Total available for use for the year ending March 31, 2022Footnote * | Used during the quarter ended June 30, 2021 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1—Operating expenditures | 33,931 | 8,148 | 8,148 |

| Vote 5—Grants and scholarships | 967,689 | 80,037 | 80,037 |

| Budgetary statutory authorities | |||

Contributions to the employee benefit plan |

3,735 | 917 | 917 |

Spending of revenues pursuant to subsection 4 (2) of the Social Sciences and Humanities Research Council Act |

95 | - | - |

| Total budgetary authorities | 1,005,450 | 89,102 | 89,102 |

Fiscal year 2020-21

| (in thousands of dollars) | Total available for use for the year ending March 31, 2021Footnote * | Used during the quarter ended June 30, 2020 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1—Operating expenditures | 26,119 | 7,413 | 7,413 |

| Vote 5—Grants and scholarships | 704,670 | 49,279 | 49,279 |

| Budgetary statutory authorities | |||

Contributions to the employee benefit plan |

3,734 | 934 | 34 |

Spending of revenues pursuant to subsection 4 (2) of the Social Sciences and Humanities Research Council Act |

95 | - | - |

| Total budgetary authorities | 734,618 | 57,626 | 57,626 |

6. Departmental budgetary expenditures by standard object (unaudited)

Fiscal year 2021-22

| (in thousands of dollars) | Planned expenditures for the year ending March 31, 2022 | Expended during the quarter ended June 30, 2021 | Year-to-date used at quarter-end |

|---|---|---|---|

| Expenditures | |||

| Personnel | 28,531 | 8,053 | 8,053 |

| Transportation and communications | 248 | 56 | 56 |

| Information | 916 | 147 | 147 |

| Professional and special services | 5,512 | 555 | 555 |

| Rentals | 1,328 | 208 | 208 |

| Repair and maintenance | 64 | 35 | 35 |

| Utilities, materials and supplies | 89 | 10 | 10 |

| Acquisition of land, buildings and works | - | - | - |

| Acquisition of machinery and equipment | 1,073 | 1 | 1 |

| Other subsidies and payments | - | - | - |

| Transfer payments | 967,689 | 80,037 | 80,037 |

| Total budgetary expenditures | 1,005,450 | 89,102 | 89,102 |

Fiscal year 2020-21

| (in thousands of dollars) | Planned expenditures for the year ending March 31, 2021 | Expended during the quarter ended June 30, 2020 | Year-to-date used at quarter-end |

|---|---|---|---|

| Expenditures | |||

| Personnel | 22,708 | 7,437 | 7,437 |

| Transportation and communications | 1,317 | 17 | 17 |

| Information | 1,044 | 80 | 80 |

| Professional and special services | 3,176 | 550 | 550 |

| Rentals | 502 | 235 | 235 |

| Repair and maintenance | 57 | 5 | 5 |

| Utilities, materials and supplies | 54 | 5 | 5 |

| Acquisition of land, buildings and works | 127 | - | - |

| Acquisition of machinery and equipment | 929 | 19 | 19 |

| Other subsidies and payments | 34 | (1) | (1) |

| Transfer payments | 704,670 | 49,279 | 49,279 |

| Total budgetary expenditures | 734,618 | 57,626 | 57,626 |

- Date modified: