Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

1. Introduction

The Social Sciences and Humanities Research Council of Canada (SSHRC) was established in 1977 by the Social Sciences and Humanities Research Council Act, and is a departmental corporation named in Schedule II of the Financial Administration Act. SSHRC is a funding agency that promotes and supports postsecondary research and training in the social sciences and humanities to enhance the economic, social and cultural development of Canada, its communities and regions. Social sciences and humanities research builds knowledge about people in the past and present, with a view toward creating a better future.

Further information on the SSHRC mandate and program activities can be found in Part II of the Main Estimates.

This Quarterly Financial Report (QFR) has been prepared by management as required by section 65.1 of the Financial Administration Act, and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates for 2014-15.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes SSHRC’s spending authorities granted by Parliament and those used by the department, consistent with the Main Estimates and Supplementary Estimates for the 2014-15 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the Government of Canada. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

SSHRC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

This quarterly report has not been subject to an external audit or review.

2. Highlights of Fiscal Quarter

Statement of Authorities

Available Authorities

SSHRC manages total authorities of $691.8 million, $332.4 million of which corresponds to the tri-agency Indirect Costs Program on behalf of the other two federal research granting agencies, the Natural Sciences and Engineering Research Council of Canada (NSERC) and the Canadian Institutes of Health Research (CIHR).

As of June 30, 2014, SSHRC’s total available authorities for 2014-15 amount to $691.8 million. To date, for 2014-15, these changes resulted in an increase in total authorities of $5.7 million (0.8%) over the prior year, of which $5.3 million represented an increase in SSHRC’s grant and scholarship programs, while the authorities for operating and employee benefits expenditures increased by $0.4 million. The changes in available authorities are the result of previous federal budget announcements that impact both the operating authorities (vote 1), and the grant and scholarship program authorities (vote 5) in the current fiscal year. The net changes between the current and previous fiscal year, comprise the following elements:

- an increase of $7.0 million in the grant and scholarship programs to strengthen research partnerships between postsecondary institutions and industry (Budget 2013);

- an increase of $0.4 million in the Business-Led Networks of Centres of Excellence program, which creates links between innovative businesses and Canada’s world-class researchers, helping to create and sustain knowledge-based jobs;

- a decrease of $1.5 million in the Centres of Excellence for Commercialization and Research program, which creates more effective and efficient ways to identify commercialization opportunities (Budget 2007); and

- a decrease of $0.2 million from a reduction in SSHRC’s travel budget and a transfer to Shared Services Canada for the streamlining of the procurement of end user device software.

Authorities Used in First Quarter

This departmental QFR reflects the results of the current fiscal period in relation to the 2014-15 Main Estimates and the Supplementary Estimates (A) (SEA), for which full supply was released by Parliament on June 20, 2014.

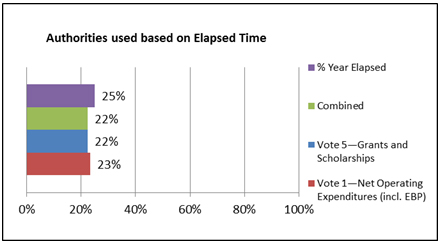

The total authorities used during the first quarter of 2014-15 amounted to $154.4 million (22% of the total available authorities; 22% of the total authorities for grant and scholarship programs; and 23% for operating expenditures and employee benefits). This represents a $30.2 million increase from the same quarter in the previous fiscal year. This increase is principally related to grant and scholarship programs ($30.8 million). For the grant and scholarship programs, the increase is a result of payment timing differences between the first and second quarters of the comparative fiscal years, which are expected to offset by year-end.

Grant and scholarship payments vary between periods due to the cycle and results of merit-reviewed funding opportunity competitions and multi-year award profiles. Operating expenditures cover personnel and other operating expenses required to support the delivery of grant and scholarship programs. Expenditures related to the Employee Benefit Plan are accounted for separately in statutory authorities. Although the majority of personnel expenditures and other operating costs are incurred in a consistent manner throughout the fiscal year, the balance of expenditures, including temporary employees hired for the peak competition season and travel costs for peer reviewers, occur in direct conjunction with the program cycle and are demand-driven. As a large proportion of program competitions occur in the last quarter of the fiscal year, the expenditures in each of the first three quarters are typically less than 25% of the annual available operating authorities.

Description of figure

SSHRC Authorities based on elapsed time, percentage of the year elapsed, combined authorities, Vote 5— Grants and Scholarships, Vote 1—Net Operating Expenditures (including EBP).

This bar graph shows SSHRC’s spending trend, in percentage of elapsed time in fiscal year 2014-15.

The x-axis shows the percentages from 0 per cent to 100 per cent.

SSHRC’s Authorities based on elapsed time in fiscal year 2014-15 was as follows:

- Percentage of year elapsed: 25 per cent

- Combined: 22 per cent

- Vote 5—Grants and Scholarships: 22 per cent

- Vote 1—Net Operating expenditures (including EBP): 23 per cent

Statement of Departmental Budgetary Expenditures by Standard Object

Variation in Amounts Available for Use in 2014-15

As described in the Available Authorities section, SSHRC’s total parliamentary authorities have increased by $5.7 million to date in 2014-15 over the prior year. The bulk of this increase is attributed to the increase in authorities for grants and scholarships ($5.3 million).

Transfer Payment Expenditures (Grants and Scholarships)

First Quarter Grant and Scholarship Expenditures

Transfer payments represent over 96% of SSHRC’s total available authorities. Variations occur in transfer payment expenditures between quarters due to the nature of the funding opportunity cycles. During the first quarter of 2014-15, SSHRC’s actual transfer payment expenditures have increased by $30.7 million over the same quarter of the previous fiscal year. The main factor for this increase is payment timing differences between comparative quarters for the following programs:

- Partnership Grants—an increase of $6.2 million due to the ramp-up of the program;

- Indirect Costs Program—an increase of $35.3 million due to earlier spending in 2014-15, some of which involved payments made in the second quarter of the previous fiscal year; and

- various grant and scholarship programs—a decrease of $10.7 million due to timing differences. The more significant decreases include $4.3 million for Insight Grants, $2.7 million for SSHRC Institutional Grants, $2.7 million for Connection Grants, and $0.7 million for the Banting Postdoctoral Fellowships Program. These timing differences are expected to be offset by year-end.

Grants and Scholarships Expenditure Trends

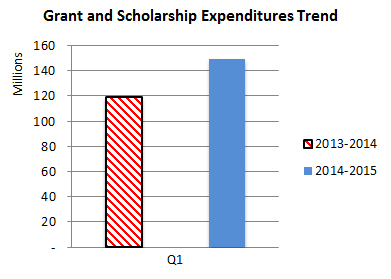

Description of figure

SSHRC first quarter Transfer Payments Expenditures Trend, 2013‑14 and 2014‑15

This bar graph shows SSHRC’s grants and scholarships spending trend, in millions of dollars, for fiscal years 2013-14 and 2014-15, for the first quarter.

The x-axis shows one quarter: Q1.

The y-axis shows dollar values. The scale begins at zero and goes to 160 million dollars, in increments of 20 million.

SSHRC’s actual spending by quarter for 2013-14, was as follows:

- Q1: 118.4 million dollars

SSHRC’s actual spending by quarter for 2014-15, was as follows:

- Q1: 149.2 million dollars

Personnel Expenditures

Personnel expenditures in support of program delivery account for the largest proportion of SSHRC’s planned operating expenditures (approximately 68% of available operating authorities and planned operating expenditures for 2014-15). The personnel expenditures for the first quarter of 2014-15 are generally in line with the previous year’s first quarter spending. The increase of $612,000 under the standard object “Other subsidies and payments” is due to a one-time transition payment for implementing salary payment in arrears by the Government of Canada.

Non-Personnel Operating Expenditures

Non-personnel operating expenditures include all other operating costs related to the support of program delivery. A significant proportion of these costs relate to funding opportunity competitions that take place predominantly during the final quarter of the fiscal year. Total non-personnel expenditures to date in 2014-2015 are generally consistent with the prior year. Decreased expenditures took place during the first quarter of this fiscal year for professional and special services ($243,000) related to the late initiation of projects requiring professional expertise and assistance. Repairs and maintenance have also seen a slight decrease ($145,000) due to the timing of maintenance that did not occur in the comparative period of the previous fiscal year.

Operating Expenditures Trend

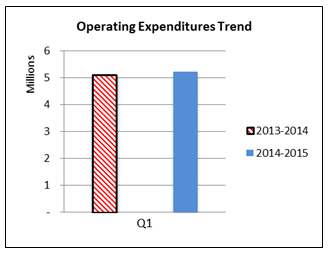

Description of figure

SSHRC Operating Expenditures Trend, first quarter, 2013‑14 and 2014‑15

This bar graph shows SSHRC’s operating spending trend, in millions of dollars, for fiscal years 2013‑14 and 2014‑15, for the first quarter.

The x‑axis shows three quarters: Q1

The y‑axis shows dollar values. The scale begins at zero and goes to 7 million dollars, in increments of 1 million.

SSHRC’s actual spending by quarter for 2014‑15, was as follows:

- Q1: $ 5.8 million dollars

SSHRC’s actual spending by quarter for 2013-14, was as follows:

3. Risks and Uncertainties

Funding and Program Delivery Risk Factors

Through the Council’s most recent corporate risk identification exercise, the risks that have a potential financial impact or that deal with financial sustainability have been assessed. The impact on SSHRC and the planned mitigation strategies related to these risks are discussed below.

External Risk Factors

SSHRC is funded through annual parliamentary spending authorities and statutory authorities for program transfer payments (grant and scholarship programs) and for its supporting operating expenditures. As a result, its program activities and operations are impacted by any changes to funding approved through Parliament. Accordingly, delivering programs can be affected by factors such as the economic climate, technological and scientific development, and evolving government priorities, which impact approved resource levels (total available authorities).

Research and innovation are part of global trends; therefore, participation in our programs is influenced not only by the Canadian context, but also by initiatives and opportunities worldwide. Formal communications and external relation strategies are developed by SSHRC to ensure that stakeholder relationships and expectations are managed effectively.

There is also the risk that SSHRC fails to achieve its mandate and strategic outcomes. To mitigate this risk, an integrated planning process is firmly in place at SSHRC. This process serves as the foundation for SSHRC to plan all aspects of its business in an integrated manner and to align priorities and resources accordingly.

Internal Risk Factors

SSHRC is a knowledge‑based organization that relies on maintaining its talented and committed workforce to deliver its programs. To retain its valuable human resources and their corporate memory, SSHRC has developed a People Strategy that outlines the organization’s commitments and action plan for developing talent and for building and sustaining a thriving and successful workplace and work culture. SSHRC’s financial restraints are challenging the ability to hire the skilled resources needed to successfully achieve the transformation and realignment agendas to meet tomorrow’s needs. Potential consequences could include workload management issues and succession planning challenges.

SSHRC is transforming its business in order to adapt more efficiently to internal changes and improve external client service.

Budgetary pressures have required internal reductions and reallocation measures. These pressures are compounded by the operational requirement to process an increasing number of applications and absorb inflationary costs on operating expenditures within limited or decreasing operational envelopes. SSHRC is also managing the requirement for the implementation of modernized technology solutions to better support program delivery.

Thus far, SSHRC has achieved the reduction of its operating pressures through economies of scale achieved by the shared administrative service arrangements with NSERC; corporate-wide prioritization and harmonization or reduction of activities; internal reallocations; and a focus on streamlining and generating efficiencies wherever possible. An established budgetary process with regular in-year budget reviews and formal reallocations for emerging priorities approved by senior management supports this endeavour. SSHRC is also undertaking a revision of its operating and grant delivery systems and processes to generate further efficiencies and future savings.

SSHRC is a lean agency; total operating expenses account for less than 4% of its annual disbursement. This efficiency is thanks partly to the continued and substantial contribution of the thousands of volunteer peer reviewers who provide immense in-kind benefit to SSHRC’s grant review operation. In addition, as noted above, SSHRC is pursuing business transformation to address restraint measures and funding cuts, and to enhance resource decision‑making.

4. Significant Changes Related to Operations, Personnel and Programs

SSHRC has undertaken a program architecture renewal initiative to create a more flexible and effective system of program application and assessment, allowing it to maximize the contributions of research and training funds for Canada’s economic prosperity and quality of life. The new program architecture has placed an emphasis on research excellence, fostering partnerships, and reporting on results. This has resulted in greater overall program coherence with flexible programming, a more responsive competition cycle, and an improved and simplified interface for applicants. The implementation of the new program architecture allows for the consolidation of existing and new funding opportunities under three umbrella programs—Talent, Insight and Connection—as well as enhanced service delivery and process re-engineering.

There were a number of important changes, in comparison with the previous fiscal year, that relate to operations, personnel and programs. These include the impacts generated by SSHRC’s previously increased available authorities, which resulted in expanded partnership program dimensions. Another significant influence involved the continuing implementation of government-wide operating budget constraint measures and the government’s efforts to return to a balanced budget, details of which are described in the section below. The federal Budget 2014, tabled in March 2014, included funding announcements describing additional program dimensions that will be implemented by SSHRC, following Treasury Board and Parliament approvals, over the course of the 2014-15 fiscal year.

5. Budget 2012 Implementation

This section provides an overview of the savings measures announced in Budget 2012 that are being implemented in order to refocus government and programs; make it easier for Canadians and businesses to deal with their government; and modernize administrative processes.

Through Canada’s Economic Action Plan, SSHRC had achieved savings of approximately $14 million as of 2013-14. Over Budget 2012, Budget 2013, and Budget 2014, the Government of Canada has reinvested $21 million annually in SSHRC’s grant and scholarship programs to support world-leading research through industry-academic partnership initiatives (including research related to labour market participation of persons with disabilities), and to increase the level of advanced research. These investments have resulted in a net increase of $7 million to SSHRC’s overall budget.

SSHRC has examined all of its activities and investments with the intention of streamlining operations and ensuring maximum efficiencies.

In realizing operating budget savings, a number of measures are being implemented to generate greater efficiency and effectiveness, including an enhanced use of technological advancements, such as teleconferencing and virtual meetings for our adjudication and merit-review processes. SSHRC has also redesigned its program architecture, which has resulted in a simpler framework for grant funding and management. A rigorous and cohesive approach to priority setting, project planning and training further helps the Council meet its goals.

Expenditures in the first quarter of 2014-15 are higher than in the same period of the previous fiscal year. The difference between the two fiscal years is due mainly to a timing difference in grant payments. The Council’s operating expenditures are decreasing—a reflection of savings resulting from SSHRC’s contribution to the Government of Canada’s efforts to return to a balanced budgetary position.

There was no incremental funding provided to SSHRC to implement the above cost saving measures.

There are no specific financial risks or uncertainties related to these savings.

Approved by:

Originally signed by:

Chad Gaffield, PhD, FRSC

President, SSHRC

August 25, 2014

Originally signed by:

Alfred Tsang, CPA, CMA

Vice-President and Chief Financial Officer, SSHRC

6. Statement of Authorities (unaudited)

Social Sciences and Humanities Research Council of Canada

Quarterly Financial Report

For the quarter ended June 30, 2014

Fiscal year 2014-15

| (In thousands of dollars) |

Total available for use for the year ending March 31, 2015* |

Used during the quarter ended June 30, 2014 |

Year-to-date used at quarter-end |

| Vote 1—Net Operating Expenditures |

22,652 |

5,246 |

5,246 |

| Vote—Netted Revenues |

75 |

- |

- |

| Vote 1—Net Operating Expenditures |

22,577 |

5,246 |

5,246 |

| Vote 5—Grants and Scholarships |

666,664 |

149,177 |

149,177 |

Budgetary Statutory

Authorities—Employee Benefits Plan |

2,509 |

627 |

627 |

| Total Budgetary Authorities |

691,750 |

155,050 |

155,050 |

Fiscal year 2012-13

| (In thousands of dollars) |

Total available for use for the year ending March 31, 2014* |

Used during the quarter ended June 30, 2013 |

Year-to-date used at quarter-end |

| Vote 1—Net Operating Expenditures |

22,122 |

5,098 |

5,098 |

| Vote—Netted Revenues |

- |

- |

- |

| Vote 1—Net Operating Expenditures |

22,122 |

5,098 |

5,098 |

| Vote 5—Grants and Scholarships |

661,336 |

118,434 |

118,434 |

Budgetary Statutory

Authorities—Employee Benefits Plan |

2,610 |

653 |

653 |

| Total Budgetary Authorities |

686,068 |

124,185 |

124,185 |

* Includes only authorities available for use and granted by Parliament at quarter-end.

7. Departmental Budgetary Expenditures by Standard Object (unaudited)

Social Sciences and Humanities Research Council of Canada

Quarterly Financial Report

For the quarter ended June 30, 2014

Fiscal Year 2014-15

| (In thousands of dollars) |

Planned expenditures for the year ending March 31, 2015 |

Expended during the quarter ended June 30, 2014 |

Year-to-date used at quarter-end |

| Expenditures: |

| Personnel |

17,718 |

4,798 |

4,798 |

| Transportation and Communications |

1,395 |

110 |

110 |

| Information |

748 |

42 |

42 |

| Professional and Special Services |

2,731 |

238 |

238 |

| Rentals |

760 |

46 |

46 |

| Repair and Maintenance |

35 |

0 |

0 |

| Utilities, Materials and Supplies |

100 |

24 |

24 |

| Acquisition of Machinery and Equipment |

1,674 |

3 |

3 |

| Other subsidies and payments |

- |

612 |

612 |

| Transfer Payments |

666,664 |

149,177 |

149,177 |

| Total Gross Budgetary Expenditures |

691,825 |

155,050 |

155,050 |

| Less revenues netted against expenditures-Netted Revenue |

75 |

- |

- |

| Total Net Budgetary Expenditures |

691,750 |

155,050 |

155,050 |

Fiscal year 2013-14

| (In thousands of dollars) |

Planned expenditures for the year ending March 31, 2014 |

Expended during the quarter ended June 30, 2013 |

Year-to-date used at quarter-end |

| Expenditures: |

| Personnel |

17,611 |

4,864 |

4,864 |

| Transportation and Communications |

1,281 |

168 |

168 |

| Information |

333 |

24 |

24 |

| Professional and Special Services |

3,815 |

481 |

481 |

| Rentals |

157 |

25 |

25 |

| Repair and Maintenance |

474 |

145 |

145 |

| Utilities, Materials and Supplies |

147 |

34 |

34 |

| Acquisition of Machinery and Equipment |

914 |

10 |

10 |

| Other subsidies and payments |

- |

- |

- |

| Transfer Payments |

661,336 |

118,434 |

118,434 |

| Total Gross Budgetary Expenditures |

686,068 |

124,185 |

124,185 |

| Less revenues netted against expenditures-Netted Revenue |

- |

- |

- |

| Total Net Budgetary Expenditures |

686,068 |

124,185 |

124,185 |